|

|

|||||||||||||||||||||||||||||||

Economics

Welcome to the economics section of Lilith Press Magazine. Here we shall discuss the ins and outs of economics - and give you some interesting statistics that will show you that sometimes things are more complicated than they seem - and that alternative routes might be the more cost-effective measure of solving economic problems. Start by rethinking what you know about Supply and Demand.

Sincerely,

Economic Theory / Disaster Capitalism

Investments

Jobs and Careers

Monetary Policy

The Economy

The Energy Sector

The Real Estate Market

Unlocking Potential: The Economic and Social Benefits of Russia's Fragmentation

By Chaz G. T. Patto - June 2023. Russia's vast territory and diverse population have historically presented both opportunities and challenges. In this essay, we explore the potential benefits of Russia splitting into separate countries, arguing that unity, while important, may inadvertently hinder the economic and social progress of various regions. By examining the advantages of fragmentation, we shed light on the possibilities for regional development, cultural preservation, and enhanced governance. Economic Autonomy and Development Fragmentation can enable regions to exercise greater economic autonomy and capitalize on their unique resources and economic potentials. Smaller countries could tailor policies and regulations to cater specifically to their economic strengths, attracting foreign investment, fostering innovation, and stimulating growth. Divided regions would have the freedom to adopt flexible economic strategies and compete globally, leading to increased prosperity and regional development. Efficient Governance and Local Empowerment Smaller, independent countries can foster more efficient governance systems by allowing decisions to be made at the local level, closer to the citizens. Decentralization of power would enable regions to address their specific social, economic, and environmental challenges with tailored solutions. Local empowerment would engender a sense of ownership and responsibility, leading to more effective administration, better public services, and responsive governance. Cultural Preservation and Identity Fragmentation can safeguard and celebrate the diverse cultural identities present within Russia. By establishing separate countries, regions would have the opportunity to prioritize the preservation and promotion of their distinct cultural heritage, traditions, and languages. Cultural diversity is a valuable asset that can foster artistic expression, tourism, and cultural exchange, enhancing social cohesion and international recognition. Regional Disparities and Inequality Russia's vastness has contributed to significant regional disparities, with certain regions benefitting more from economic development and government resources. Fragmentation can address these inequalities by allowing regions to focus on their specific needs and allocate resources more equitably. This would lead to a more balanced distribution of wealth, infrastructure development, and improved living standards, thus fostering social cohesion and reducing interregional tensions. Innovation and Competition Fragmentation encourages healthy competition among regions, spurring innovation and productivity. Independent countries would be motivated to develop unique strengths and attract talent, investment, and businesses. Increased competition fosters an environment of continuous improvement, technological advancement, and economic diversification, benefiting both the regions and the overall competitiveness of the entire area. Democratic Accountability and Political Stability Smaller countries often find it easier to maintain democratic accountability and foster political stability. Fragmentation would promote a closer connection between citizens and their governments, enhancing transparency, citizen participation, and responsiveness. With smaller populations to govern, regional governments could focus on building robust democratic institutions, fostering political stability, and promoting social cohesion. While unity has its merits, exploring the potential benefits of Russia's fragmentation reveals compelling arguments for regional independence. Economic autonomy, efficient governance, cultural preservation, reduced inequality, innovation, and democratic accountability are among the advantages that could be realized through the establishment of separate countries. By embracing fragmentation, Russia could unlock the diverse potential of its regions, fostering economic and social development, preserving cultural heritage, and empowering local communities. It is important to acknowledge that the hypothetical scenario of fragmentation should be approached with caution, considering the complexities and challenges it may entail. Nonetheless, envisioning a future where regions harness their individual strengths offers valuable insights into the potential benefits of decentralization.

|

|

||||||||||||||||||||||||||||||

|

Why TD Waterhouse and Brokerages like it are Hindering the Canadian EconomyBy C.M. - February 2021. TD Canada Trust is a Canadian bank and they operate a brokerage firm called "TD Waterhouse". I content however that it (and companies) like it are actually hindering the Canadian economy through unfair and unreasonable fees. Pretend for a moment that you want to invest some money in Canadian stocks and you decide you want to set $100 aside each month to buy various stocks, to the tune of $1200 per year, in addition to other investments in bonds, RRSPs, etc. Well, brokerages like TD Waterhouse charge you a fee every time you buy stocks - even though they don't need to since everything is automated with computers and they make a lot of their money through other methods asides from fees. Guess what the fee is? If you guessed $1 or $1.50 you'd be wrong. It is $9.99. Basically $10 every time you buy a stock, regardless of the number of stocks you buy, or what their value is. So if you buy $100 worth of Tim Hortons stock you have to pay $9.99, meaning your total expenditure is $109.99 for stocks that are only worth $100. So if someone wanted to buy $100 of stock each month (which seems reasonable) they would end up being charged $119.88 in fees per year. Do you see what I am getting at? TD Waterhouse is ultimately hindering investments in Canadian stocks, and consequently hindering the Canadian companies and the economy as a result. It is also unfairly preventing poor and middle class people from investing in the economy using unfair (and unnecessary) fees. Meanwhile other Canadian companies like Weathsimple and Questrade charge zero fees for buying stocks and make their money through other methods. Eg. Wealthsimple makes most of their fees from when people sell their stocks, and only when someone sells $500 worth of stock or more. (Thus if it is $400 worth of stock being sold the trade is free.) In the USA there are also companies like Robinhood which similarly don't charge fees for basic trades, and other charge fees for certain other tasks. However Robinhood is for US citizens or residents only and they currently don't operate in Canada. Big Canadian banks make a lot of their money by overcharging people with lots of banking fees, often for things that should logically be a free service. However these same banks are like dinosaurs, as I found out recently when I tried to reset my TD Waterhouse trading pin number, as the system to do so is so convoluted, their website so badly designed, their phone system involves waiting for hours and nobody answering the phone, and I only finally got somewhere when I went to the bank in person (3 times!) in order to get my trading pin reset. And then I went home and their website wasn't working properly and when it did eventually work I got a message that the trading pin had already expired - with no instructions on how to renew it. This was the breaking point for me. It was the moment I asked myself: "Why am I paying $9.99 for buying stocks via TD Waterhouse when I could just switch to Wealthsimple and pay zero fees?" And also "Why I am paying $9.99 fees to a bank with such horrible service and clearly cannot be bothered to answer the bloody phone?" And now you know why I felt compelled to dump TD Waterhouse, sell all my stocks, and rebuy all of my stocks via Wealthsimple. Because they bloody well lost me as a customer. Think about it for yourself? If you were doing business with a bank that treats you horribly and charges ridiculous fees would you stick around due to loyalty? Because they obviously don't deserve your money. I expect that 79 years from now (by 2100) these dinosaur banks won't even exist any more and will have been replaced with banks that offer better service. They will have gone extinct while their smarter and more customer friendly competitors will have left them in the dust. Competitors that will allow average Canadians to invest in the Canadian economy without taking a $10 hit every time they buy stocks.

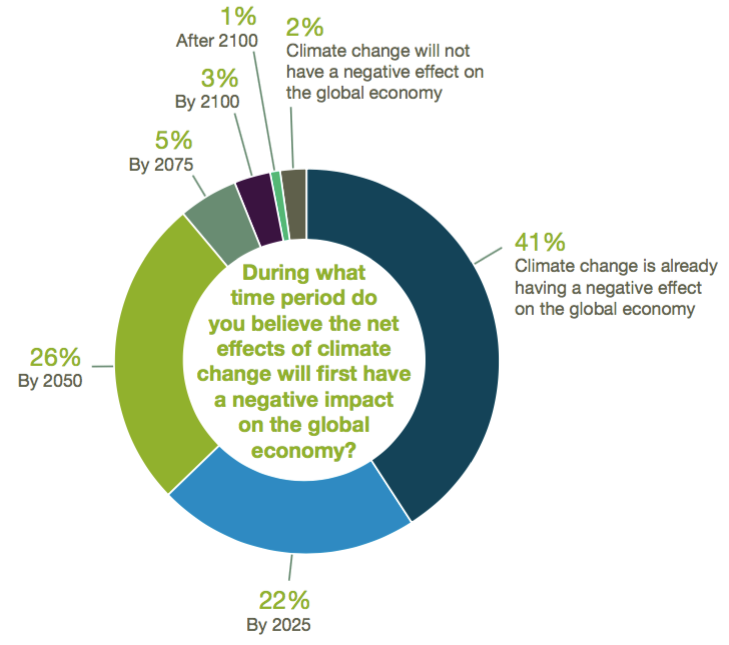

Climate Change To Affect Americaís EconomyMarch 2019. We, as a collective, are starting to realise the ramifications of climate change. From rising sea levels to increased warming from unchecked carbon emissions, thousands of scientists across the world are screaming for action to be taken, and with over 123 countries taking part in school marches and protests, we may yet see governments around the globe start putting in stricter policies to control the amount of damage weíre doing to the ecosystem. But some countries have doubled down on their carbon emissions and pollution numbers, and one of these is the United States. With more than a dozen environment reforms cast out by the current president, many are expecting that the country will be at the forefront of the extreme weather that has been predicted by experts. But the physical environment is not where the damage stops, and itís believed that the US will start haemorrhaging billions in order to stave off some of the worse effects of climate change. A 1,600 page assessment, known as the Fourth National Climate Assessment, that was mandated by Congress, details the economic devastation that will be inflicted on the country should they continue to remain at current deforestation, consumption, and emission levels, and is a fascinatingly horrifying read in between sessions of Game of Thrones. Labour Loss Labour is one of the first sectors that will be hit as a direct result of the costs of keeping the country afloat amid a climate crisis. They predict that by the end of the century, extreme heat will see massive productivity losses in jobs that require workers be outside for any extended periods of the day. This directly affects those that work in construction and agriculture, both pillars of the economy. They expect that the losses of labour could cost the country an estimated $160 billion a year in lost wages alone. Infrastructure Damage They estimate that around $507 billion worth of property and real state is currently in the firing line of rising sea levels, which will begin to envelope all of the countryís major city centres, such as New York City. The financial damage doesnít come to a stop on the coastline however; as itís expected that flooding could destroy bridges that would see damage costs of around $1.4 billion a year by the time 2050 starts. Energy Costs Along with sea levels and bridges, extreme weather will start to impact how well the countryís infrastructure can stay well maintained. This will also affect the distribution of electricity throughout the nation, and they expect that energy costs will explode to around $87 billion a year by 2100. This will be caused by constant increases to the demand on the power grid that will slowly become less and less reliable as weather becomes more extreme. Environmental Capital Ocean acidification is a set to start eating away at the capital produced by the environment. The fishing and tourism industry is set to begin to collapse as fish stocks plummet and coral reef die, with an added burden on the government of $140 billion a year.

Tips for Filing Taxes as an Online Business OwnerApril 2020. As most business owners know, filing taxes is no fun. The tax law is very confusing and can leave you feeling in over your head. It is easy to get frustrated when trying to file, but with a few tips in mind, you can be less stressed this tax season. For those trying to manage tax season as business owners, it is important to keep a few things in mind. These include having a trusted accountant, maximizing your deductions, and keeping accurate records. In the end, this can save you many hours of headaches.

Have a Trusted AccountantYour business should have one accountant that you go to for your business purposes. Whether you are a small business or a larger online one, you need an accountant that you can depend on. You will likely have questions during tax season, and this person will be your go-to during this time. If your business is ever audited, this person can serve as an advocate for you and help you with this situation.

Maximize Your DeductionsSmall businesses have several types of tax deductions that can be taken. These include vehicle expenses, home office expenses and office supplies. Be sure to keep your receipts throughout the year so that you can go through and maximize your deductions. You can use an online receipt-saving service to help you keep everything more organized and to reduce paper clutter. Some phone apps are available to keep up with receipts too.

Keep Accurate RecordsIf you keep good records throughout the year, it will be easier for you to find everything you need during tax season. You do not want to have to go digging through piles of paper to find a certain form or receipt. Invest in a filing cabinet that will help you keep everything you need organized and ready to go. This will make it much easier for you and your accountant to meet deadlines for filing taxes. Keeping up with taxes can be difficult for anyone, especially business owners. If you feel lost about where to begin with your tax filing, consider these tips to help make things easier. While it can be difficult, it does not have to be impossible to get your taxes done quickly and accurately. Make a resolution to keep your business documents organized so that you feel fully prepared when taxes come due this year.

Real Estate EconomicsIn Canada, condos in Toronto and Vancouver are becoming increasingly expensive and difficult to afford. As the cities grow upwards instead of outwards, city living is becoming increasingly cramped and "neighbours" usually end up becoming nameless people you see in the hallways. Toronto Condos and Highrises takes an indepth look at how these architectural behemoths are changing the landscape of Canada's biggest city - and changing how neighbourhoods work, think about themselves, and their population density.

The Economics of Homelessness

At any given time there is approx. 50,000 homeless people in the Greater Toronto Area. 50,000. That is enough for a small city, all by itself. What is even more surprising about that number is that the majority of that 50,000 homeless people have jobs. They are NOT unemployed. They are working, they just cannot afford the cost of renting an apartment because apartment prices in Toronto are too high. Stop and think about that. It has nothing to do with homeless people being lazy or crazy (only 6% of homeless people suffer from schizophrenia). There people are not lazy. They're working. They just can't find an apartment that is "affordable". And its not just the cost of the apartment itself. Its the cost of heating it. Electricity. Water. Utility bills in general. Add in a phone bill monthly and you can end up paying quite a bit. Lets pretend you find a basement apartment for 1 person for $700, but the cost of electricity is not included. The extra electricity might cost you another $100 per month, and your phone $50 per month. Already you are looking at $850 per month. Budget wise you might be spending $100 on food, $50 on clothing / toiletries, if you have old debts you might also have $200 payments every month. So we're up to $1,200 already, monthly. Dentist bills, medications, unexpected trips for funerals. New glasses once every several years. Now what happens if you are working FULL TIME, 40 hours per week, but getting paid minimum wage? The minimum wage in Ontario is $10.25 per hour. Times 40 hours that is $410 per week... minus income taxes, pension plan, employment insurance. Take home pay will be about $320 per week. So that is $1,280 every 4 weeks. Not a lot of leeway when it comes to budget. Now lets pretend you aren't getting 40 hours per week. You might only be getting 30. Suddenly you can't afford to live in that basement apartment any more because you simply are not making enough. If you cut back on various things, you might be able to pay your rent, but you won't be able to pay your electricity bills, buy food, pay off old debts... debt collectors will start calling, you may end using your credit card a lot more to rack up more debt... It becomes a huge balancing act just to get from month to month. What we really need is some kind of subsidy for low income workers so their electricity bills aren't so steep. And while we are at it we also need more subsidies for affordable housing. Toronto has enough expensive condos (they're building them like crazy), what we really need is more affordable housing. Anti-poverty activists in 2013 are calling for a $14 minimum wage this year. They're probably not going to get it because in May 2013 the Liberal government said they had no plans to raise the minimum wage this year. They might raise it in 2014, but its doubtful they will raise it this year. A more progressive stance would be to raise the minimum wage 25 cents every year. $10.50 this year, $10.75 in 2014, $11 in 2015, etc. At least then it would be progress. A more aggressive approach would be 25 cents this year, and 50 cents more every year after that. Now you might think this is going to hurt businesses. It won't. The only companies paying their employees minimum wage is places like McDonalds, Burger King, Tim Hortons, etc. They can afford to tighten their belts a bit. It makes you realize that solving homelessness is actually really easy. You just raise the minimum wage and provide subsidies for more affordable housing. If you don't then I would like to remind you that the Canadian government spends approximately $6 billion annually on emergency services, community organizations, and non-profits specifically aimed at homeless people. SIX BILLION. The numbers add up to approx. $20,000 per year per homeless person. The Canadian government would actually SAVE money simply by having more subsidies for affordable housing. Raising the minimum wage would also be a dramatic shift towards an economy where more people have both jobs and a home, they're well paid, and they can afford the place they are living in. Quotes about Homelessness in Toronto by charity worker / activist Edward de Gale "Canada is the second coldest country on earth and with a climate like Canadaís, energy, like food and housing is a necessity of life." - Edward de Gale. "It is a little known fact that the inability to pay basic utilities/energy is the second leading economic cause of homelessness in this country." - Edward de Gale. "Over 50,000 households a year have their power disconnected in Ontario while thousands of others struggle to provide the necessary energy to stay warm and cook meals. Thatís one household with their power cut every 10 minutes, every hour, of every day, for a year." - Edward de Gale. "Many Ontario households must choose between eating and heating, and seniors and those with special needs must choose between medication and heating." - Edward de Gale. "Families, with minor children, unable to provide basic utilities/energy for their children are vulnerable to child protection orders because they are unable to provide the necessities of life." - Edward de Gale. References

Website Design + SEO by designSEO.ca ~ Owned + Edited by Suzanne MacNevin |

|||||||||||||||||||||||||||||||