|

|

|||||||||||||||||||||||||||||||

|

Redefining a Recession - American Economics

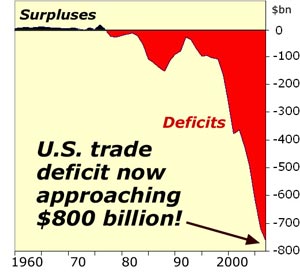

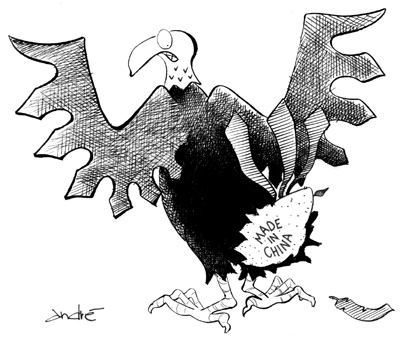

False Definition of a RecessionBy Charles Moffat - March 3rd 2008. The technical definition of a recession is when you have two consecutive quarters of lower gross domestic product. These means 6 straight months of people making less products, goods, foods, etc. But what if people are making the products, but nobody is buying them? This is my point. The technicaly definition of a recession is too narrow. It ignores the possibility that people have simply stopped buying things. Imagine for a moment if people were only buying necessities like food and clothing. They already have a big flatscreen TV, a computer, an iPod, a BlackBerry, a toaster and everything else they need or want. They have a house and a mortgage and two cars in the driveway. What more could they possibly need or want? Economic growth is driven by new technology, by people WANTING the newest and latest thing. If there isn't a new exciting thing to go out and buy the economy starts to stagnate. In this case people have also become overloaded with debt, bad mortgages and either already have everything they want (and are saving their money) or they cannot afford such things because they are more worried about their debt or their mortgage. Part of the problem is our reliance on foreign goods. Many products these days are built in Japan, China and other parts of Asia. We need to stop buying those products and buy things that are manufactured in North America. The United States has a trade deficit of over $700 billion and approx. 80% of that is products from China alone and our soaring oil consumption. Chinese products cost less because China deliberately deflates the value of the yuan in order to be ridiculously competitive. By the time it reaches the consumer they have a choice: Do we want to buy the American Air Conditioner for $199.99 or the Chinese Air Conditioner for $129.99?

We could raise tariffs (an import tax) on Chinese products but China would only deflate the yuan even more (and raise imports taxes on American products going to China, which they rarely buy anyway). The only real solution is for people to buy more locally manufactured products. Don't buy anything made overseas, with the possible exception of food. The other problem is oil consumption, which can only be fixed if we cut back on how much we drive, what we drive or if we drive at all. It will be years before hydrogen fuel cell cars hit the road and an hydrogen network is established across Canada and the United States. When it does happen however it might provide the economic stimulus we need. A whole new era of people buying hydrogen cars built in North America, hydrogen converters for their homes, and possible solar panels and windmills for their homes as well. Green energy could be the answer to our economic woes. People think going green will be expensive. I say SO WHAT? If it is expensive yet people do it anyway that just means it will boost our economy even more. Over time it will become less expensive anyway as China starts mass producing similar goods... at which point we will have to ask ourselves? Do we want to buy the American Windmill for $199.99 or the Chinese Windmill for $129.99? I say pay the extra $70 and keep North America's economy strong.

U.S. in recession, says Warren BuffettBillionaire Warren Buffett said Monday that the U.S. economy is essentially in a recession even if it hasn't met the technical definition of one yet. Buffett said in an interview with cable network CNBC the reports he gets from the retail businesses his holding company owns show a significant slowdown in purchases. The chairman and CEO of Omaha-based Berkshire Hathaway Inc. said millions of people have also lost equity in their homes because home prices have dropped. "I would say, by any commonsense definition, we are in a recession," Buffett said on CNBC. But Buffett said it's not clear how far the recession will go because that is difficult to predict. The technical definition of a recession most economists use is two consecutive quarters of negative growth in the nation's gross domestic product. On Thursday, the Commerce Department reported that the gross domestic product increased at a low 0.6 percent pace in the quarter that ended Dec. 31. In the July-September quarter, the economy grew at a brisk 4.9 percent. Gross domestic product measures the value of all goods and services produced in the United States and is the best barometer of the country's economic health. A survey released last week by the National Association for Business Economics showed that 45 percent of economists are predicting a recession in 2008. But Buffett said the U.S. economy will be fine in the long run. "Over time, my children are going to live better than I do, although they don't believe it," Buffett said. Buffett's appearance on television came on the heels of his annual letter to shareholders, which he released Friday along with Berkshire's 2007 financial report. In the letter, Buffett predicted that the insurance industry will see lower underwriting profit margins in 2008 because premium prices are down, and the industry's luck will certainly change. "It's a certainty that insurance-industry profit margins, including ours, will fall significantly in 2008," he said. ``Prices are down, and exposures inexorably rise. Even if the U.S. has its third consecutive catastrophe-light year, industry profit margins will probably shrink by 4 percentage points or so. "If the winds roar or the earth trembles, results could be far worse.'' Buffett said Berkshire's insurance group, which includes GEICO, reinsurance giant General Re and several other firms, generated $2.2 billion net income from insurance underwriting in 2007. That's down from the previous year when it posted a $2.5 billion underwriting profit. When Berkshire's shareholders aren't worrying about insurance profits, they're likely fretting about who will run Berkshire after Buffett is gone. The 77-year-old Buffett offered a few new clues in his annual letter and during the CNBC interview. To replace Buffett, Berkshire plans to split his job into three parts – chief investment officer, chief executive officer and chairman. Buffett wrote in his letter that over the past year he identified four investment managers outside Berkshire who could take over managing the company's $75 billion stock portfolio and investing its $44.3 billion cash. Buffett said on CNBC that none of the four CIO candidates is a woman and that very few women applied for the job. Buffett has previously said that Berkshire's board had three outstanding internal candidates for chief executive. And Buffett's son, Howard, who already serves on Berkshire's board, will become chairman after Warren Buffett's death. Buffett also said on CNBC:

Berkshire owns more than 60 subsidiaries including insurance, clothing, furniture, natural gas, corporate jet and candy companies. Berkshire also has major investments in such companies as Coca-Cola Co. and Wells Fargo & Co.

Primary EconomicsProfessor Peter Morici - March 3rd 2008. The Texas and Ohio primaries could well determine the Democratic nominee for President. Its high time Barak Obama and Hillary Clinton quit musing about change and explain what they will do to fix the economy. The trade deficit exceeds $700 billion. China and oil account for 80 percent and significantly contribute to rising inflation and unemployment. Each year, Beijing prints and sells about $460 billion worth of yuan for dollars, euros and other currencies at cut rate prices. Currency manipulation floods U.S. stores with Chinese apparel, electronics and appliances. Unfortunately, Chinese manufacturing uses oil less efficiently than western competitors. Export-driven growth in China, driven by currency subsidies, has pushed oil to $100 a barrel, and U.S. energy prices are up 20 percent over the last year. Congress passed the 2007 Energy Policy Act, which requires little more in automotive fuel efficiency than higher gasoline prices would compel and propagates the fiction we can feed cars corn to end our oil addiction. Subsidizing ethanol pushes up grain prices. Consequently, food prices are rising 5 percent a year. Now energy and food inflation are spreading. Overall, consumer prices rose 6.8 percent for the three months ending in January. China, Saudi Arabia and other major exporters use their extra dollars to buy U.S. securities and property. Until recently, banks recycled foreign money to American consumers by offering easy credit cards and mortgages, and combining those loans into securities for sale in bond markets.

Now, we learn the banks didn't create legitimate bonds. Instead, they sliced loans into incomprehensibly complex derivatives, then sold, bought, resold, and insured those contraptions to generate fat fees and million dollar bonuses for bank executives. Alchemy discovered, banks can no longer repackage loans into bonds and are pulling back lending. Home prices tank, consumers spend less, businesses fail, and jobs disappear. Stimulus package tax rebates, interest rate cuts and Administration help for distressed homeowners are palliatives. A permanent solution requires fixing the trade deficit, oil consumption and the banks. Asian currency shenanigans have destroyed two million manufacturing jobs. Bills in Congress would permit U.S. workers to get relief, much as they can from other unfairly subsidized imports. President Bush opposes those solutions, and Obama and Clinton support weaker legislation that would continue U.S. policy of begging China to change. Obama and Clinton should embrace realistic policies toward China. Otherwise, voters can pick McCain in November. At least he is honest about doing nothing. The candidates should speak candidly to Americans about accepting moderately more-expensive hybrid and plug-in vehicles to reduce gasoline consumption, and nuclear power to get more electricity. Bankers cannot borrow at five percent and write mortgages at seven, and pay themselves like rock stars. To keep the fantasy, bankers are busy selling huge equity shares to the Asian and Middle Eastern governments. Obama and Clinton should explain how they would stop sharp banking practices but are too busy raising campaign cash on Wall Street. Americans can vote for McCain if they want that too.

|

|

||||||||||||||||||||||||||||||

|

Website Design + SEO by designSEO.ca ~ Owned + Edited by Suzanne MacNevin | |||||||||||||||||||||||||||||||